Managing Cash Flow with Revolving Business Credit Lines: A Comprehensive Guide

Embark on a journey of understanding and optimizing cash flow with revolving business credit lines. This guide delves into the key aspects of managing cash flow effectively in the business realm.

Exploring the intricacies of revolving credit lines and their impact on financial stability, this guide offers practical insights and strategies for maximizing their benefits.

Understanding Revolving Business Credit Lines

Revolving business credit lines are a type of financing that provides businesses with access to a predetermined amount of funds that can be borrowed, repaid, and borrowed again. Unlike traditional term loans, revolving credit lines allow businesses to draw funds as needed, up to a set credit limit, and only pay interest on the amount borrowed.Some benefits of using revolving business credit lines for managing cash flow include:

Flexibility

Businesses can access funds when needed without having to reapply for a new loan each time.

Cost-effectiveness

Interest is only paid on the amount borrowed, which can be more cost-effective than taking out a lump sum loan.

Cash flow management

Revolving credit lines provide a safety net for unexpected expenses or fluctuations in revenue.

Key Features of Revolving Business Credit Lines

- Revolving credit limit: Businesses have access to a predetermined credit limit that can be used multiple times.

- Revolving interest: Interest is only charged on the amount borrowed and not the entire credit limit.

- Revolving repayment: As funds are repaid, they become available to be borrowed again, providing ongoing access to capital.

- Revolving terms: Repayment terms are typically more flexible than traditional term loans, allowing for greater control over cash flow.

How Revolving Business Credit Lines Impact Cash Flow Management

Revolving business credit lines play a crucial role in managing cash flow effectively for businesses. These credit lines provide a flexible source of funding that can be accessed as needed, helping businesses navigate through cash flow challenges and unexpected expenses.

Benefits of Utilizing Revolving Credit Lines

- Immediate Access to Funds: Businesses can quickly access funds from their revolving credit lines to cover operational expenses or take advantage of growth opportunities.

- Flexible Repayment Options: Revolving credit lines offer flexible repayment terms, allowing businesses to repay the borrowed amount based on their cash flow situation.

- Improving Cash Flow: By using revolving credit lines strategically, businesses can smooth out cash flow fluctuations and maintain financial stability.

Examples of Using Revolving Credit Lines

- Seasonal Businesses: A retail business that experiences fluctuating sales throughout the year can use a revolving credit line to bridge the gap during slow seasons and manage cash flow effectively.

- Emergency Expenses: In case of unexpected expenses or emergencies, businesses can rely on revolving credit lines to cover immediate costs without disrupting their operations.

Potential Risks of Relying on Revolving Credit Lines

- Accumulating Debt: Continuously relying on revolving credit lines without a solid repayment plan can lead to accumulating debt and financial strain for businesses.

- High Interest Rates: Revolving credit lines often come with higher interest rates compared to traditional loans, increasing the cost of borrowing for businesses.

- Impact on Credit Score: Maxing out revolving credit lines or missing payments can negatively impact the business’s credit score, affecting future financing options.

Utilizing Revolving Credit Responsibly

When it comes to utilizing revolving credit responsibly, there are several best practices to keep in mind. It is important to understand the advantages and disadvantages of using revolving credit lines compared to traditional loans for effective cash flow management.

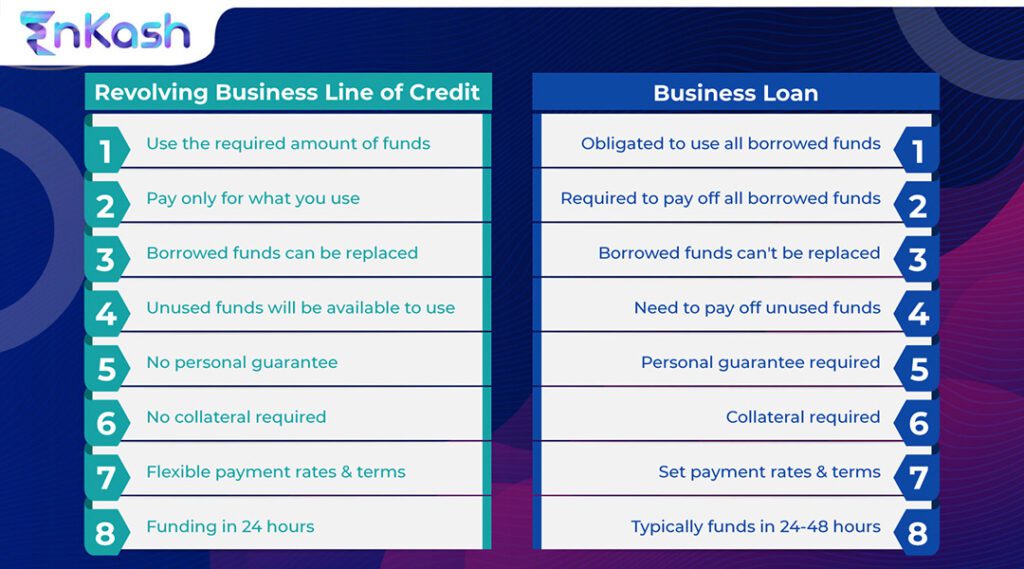

Comparing Revolving Credit Lines vs. Traditional Loans

- Advantages of Revolving Credit Lines:

- Flexibility in borrowing and repaying funds as needed

- Ability to access funds quickly in case of emergencies

- Interest is only charged on the amount borrowed

- Disadvantages of Revolving Credit Lines:

- Higher interest rates compared to traditional loans

- Potential for overspending and accumulating debt

- Variable interest rates can lead to unpredictability in payments

- Advantages of Traditional Loans:

- Fixed interest rates for the duration of the loan

- Predictable monthly payments

- Suitable for larger, one-time investments

- Disadvantages of Traditional Loans:

- Less flexibility in borrowing and repaying funds

- Longer approval process compared to revolving credit lines

- May require collateral for approval

Incorporating Revolving Credit Lines into Cash Flow Management

Designing a strategy for incorporating revolving credit lines into a comprehensive cash flow management plan involves:

- Evaluating the business’s cash flow needs and determining the appropriate credit limit

- Setting clear guidelines for when and how to use the revolving credit line

- Regularly monitoring and assessing the impact of the credit line on cash flow

- Creating a repayment plan to minimize interest costs and pay off the balance efficiently

- Utilizing the credit line for short-term cash flow gaps or strategic investments to grow the business

Maximizing the Benefits of Revolving Credit Lines

Revolving credit lines can be powerful tools for managing cash flow and fueling business growth. By understanding how to maximize the benefits of revolving credit lines, businesses can leverage these financial resources effectively for both short-term and long-term needs.

Leveraging Revolving Credit Lines for Business Growth

One of the key ways to maximize the benefits of revolving credit lines is to use them strategically for business growth and expansion. This can include:

- Investing in new equipment or technology to improve efficiency and productivity.

- Expanding product lines or services to reach new markets and increase revenue streams.

- Funding marketing campaigns to raise brand awareness and attract more customers.

- Acquiring other businesses to strengthen market position and diversify offerings.

Accessing and Managing Revolving Credit Lines Efficiently

To access and manage revolving credit lines efficiently, businesses should follow a step-by-step guide:

- Evaluate the business’s financial needs and determine the amount of credit required.

- Research and compare different lenders to find the best terms and rates for the revolving credit line.

- Submit a well-prepared application with accurate financial information and a solid business plan.

- Maintain regular communication with the lender and provide updates on how the credit line is being used.

- Monitor cash flow closely to ensure that the credit line is being utilized effectively and payments are made on time.

Last Point

In conclusion, mastering the art of managing cash flow with revolving business credit lines is crucial for sustainable business growth. By implementing the best practices Artikeld in this guide, businesses can navigate financial challenges with confidence and precision.

Questions Often Asked

How can revolving business credit lines benefit cash flow management?

Revolving credit lines provide flexibility and quick access to funds, allowing businesses to address short-term cash flow gaps efficiently.

What are the risks associated with relying on revolving credit lines for cash flow management?

One major risk is accumulating high interest costs if the credit lines are not managed responsibly, potentially leading to financial strain.

How can businesses leverage revolving credit lines for growth and expansion?

By using revolving credit lines strategically to fund expansion projects or capitalize on growth opportunities, businesses can propel their growth trajectory.