Low Interest Business Line of Credit for Small Enterprises: A Comprehensive Guide

Exploring the realm of Low Interest Business Line of Credit for Small Enterprises, this introduction sets the stage for a detailed and insightful discussion. It sheds light on the significance of this financial tool for small businesses and how it can impact their growth and stability.

In the subsequent section, we will delve deeper into the specifics of what defines a low interest business line of credit and why it stands out among various financing options available to small enterprises.

Definition of Low Interest Business Line of Credit

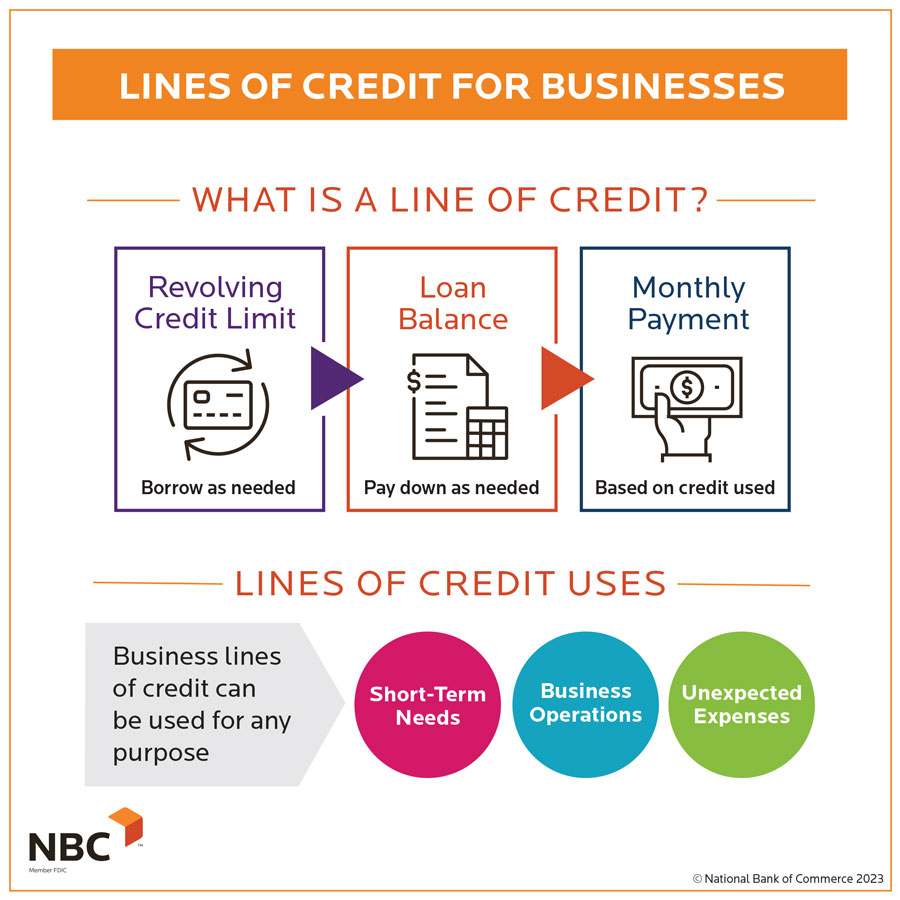

A low interest business line of credit is a financial product offered to small enterprises that allows them to borrow funds up to a predetermined limit. The key feature of a low interest business line of credit is that the interest rates charged on the borrowed amount are relatively lower compared to other types of financing options available in the market.

How it Differs from Other Types of Financing

- Flexibility: Unlike traditional loans where borrowers receive a lump sum amount, a business line of credit allows small enterprises to access funds as needed, up to a specified limit.

- Revolving Nature: Once the borrowed amount is repaid, the credit line is replenished, providing ongoing access to funds without the need to reapply for a new loan.

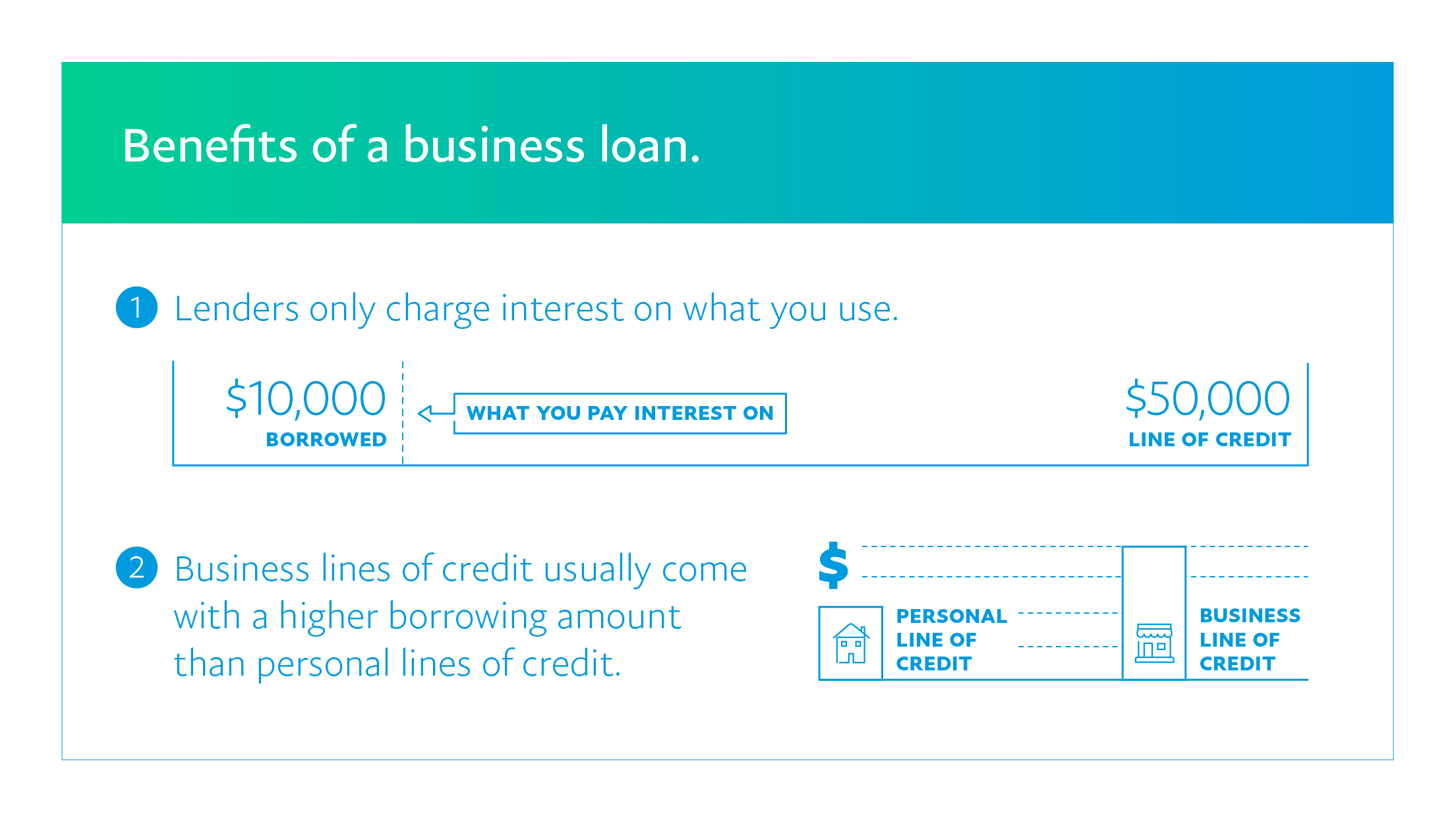

- Interest Rates: Low interest business lines of credit typically offer lower interest rates compared to credit cards or other short-term financing options.

Examples of Situations where it is Beneficial for Small Enterprises

- Managing Cash Flow: A low interest business line of credit can help small enterprises smooth out cash flow fluctuations, especially during seasonal or cyclical business cycles.

- Opportunity for Growth: Small businesses can use a business line of credit to seize growth opportunities, such as expanding operations, launching new products, or investing in marketing initiatives.

- Emergency Expenses: In case of unexpected expenses or emergencies, having a low interest business line of credit in place can provide a quick and convenient source of funds to address the situation.

Importance of Low Interest Business Line of Credit for Small Enterprises

Small enterprises often face financial challenges and may require access to additional funds to support their operations. A low interest business line of credit can be a valuable financial tool for these businesses.

Why Small Enterprises May Need a Low Interest Business Line of Credit

A low interest business line of credit provides small enterprises with a flexible source of funds that they can access as needed. This can be particularly beneficial for businesses that experience fluctuations in cash flow or unexpected expenses.

How It Can Help with Cash Flow Management

- Allows businesses to cover temporary cash shortages without resorting to high-interest loans.

- Provides a safety net for managing day-to-day expenses during slow periods.

- Helps in maintaining a consistent cash flow to meet financial obligations and invest in growth opportunities.

How It Can Be Used for Business Expansion or Unexpected Expenses

- Supports business expansion by providing the necessary funds for investing in new projects, hiring additional staff, or purchasing equipment.

- Acts as a buffer for unexpected expenses such as repairs, emergency purchases, or sudden increases in operating costs.

- Enables businesses to take advantage of growth opportunities without disrupting their existing cash flow.

Qualifications and Requirements for Obtaining a Low Interest Business Line of Credit

When applying for a low interest business line of credit, small enterprises need to meet certain qualifications and requirements to secure this type of financing. The process can vary depending on the lender, but there are some common factors that businesses should be prepared for.

Typical Qualifications Needed

- A good credit score: Lenders will often look at the credit score of the business owner or the business itself to determine creditworthiness.

- Business history: Having a solid business history and positive cash flow can improve your chances of approval for a low interest line of credit.

- Collateral: Some lenders may require collateral to secure the line of credit, especially for larger amounts.

Documentation and Financial Information Required

- Business financial statements: Prepare financial statements, including income statements and balance sheets, to demonstrate the financial health of your business.

- Tax returns: Providing past tax returns can show the stability of your business income.

- Business plan: Lenders may ask for a detailed business plan outlining how the line of credit will be used and how it will benefit the business.

Tips to Improve Approval Chances

- Improve credit score: Work on improving both personal and business credit scores to increase your chances of approval.

- Build a strong business history: Showing a track record of success and growth can make your business more attractive to lenders.

- Prepare a detailed business plan: Clearly Artikel how the line of credit will be used and how it will benefit your business to demonstrate your ability to repay the loan.

Comparing Low Interest Business Line of Credit with Other Financing Options

When it comes to financing options for small enterprises, it’s important to weigh the pros and cons of each to make an informed decision. Let’s compare a low interest business line of credit with other common financing options like term loans and business credit cards.

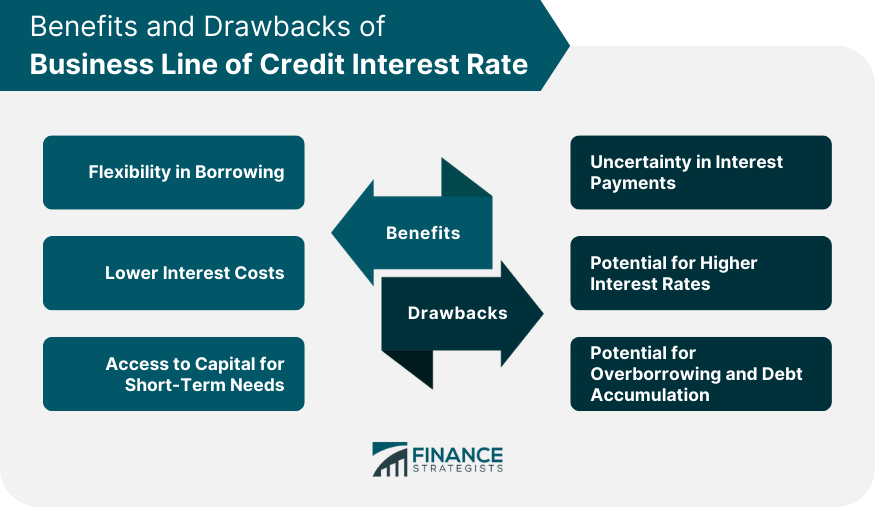

Advantages and Disadvantages of Low Interest Business Line of Credit vs. Term Loans

Low interest business lines of credit offer flexibility in terms of borrowing and repayment, allowing small enterprises to access funds as needed and only pay interest on the amount borrowed. On the other hand, term loans provide a lump sum upfront, but come with fixed repayment schedules and interest rates.

While lines of credit may have lower interest rates, they can be more difficult to qualify for compared to term loans.

Differences in Usage and Costs between Business Line of Credit and Credit Cards

Business credit cards are convenient for day-to-day expenses and offer rewards, but come with higher interest rates compared to business lines of credit. Lines of credit are better suited for larger expenses or ongoing cash flow needs, with lower interest rates and higher credit limits.

However, lines of credit may have stricter repayment terms compared to business credit cards.

Flexibility of Low Interest Business Line of Credit compared to Traditional Loans

Unlike traditional loans that provide a fixed amount of funds upfront, a business line of credit offers flexibility in borrowing and repayment. Small enterprises can access funds when needed, up to a predetermined credit limit, and only pay interest on the amount borrowed.

This flexibility allows for better cash flow management and the ability to address unexpected expenses or seize growth opportunities without the constraints of a term loan.

Final Conclusion

In conclusion, the discussion on Low Interest Business Line of Credit for Small Enterprises has unraveled the intricacies of this financial lifeline for businesses. It has highlighted the importance of prudent financial management and access to credit for small enterprises to thrive in a competitive market environment.

FAQ Overview

What are the typical qualifications for obtaining a low interest business line of credit?

Qualifications usually include a good credit score, stable revenue, and a solid business plan.

How can a low interest business line of credit help with cash flow management?

It provides a flexible source of funds that can be used to cover operational expenses during lean periods.

How does a low interest business line of credit differ from business credit cards?

A line of credit offers lower interest rates and greater flexibility in repayment compared to credit cards.