Unsecured Business Lines of Credit for New Businesses: A Comprehensive Guide

Delving into the realm of Unsecured Business Lines of Credit for New Businesses, this guide promises to unravel the complexities and benefits of this financial tool. Brace yourself for an enlightening journey through the world of business credit.

What are Unsecured Business Lines of Credit?

![]()

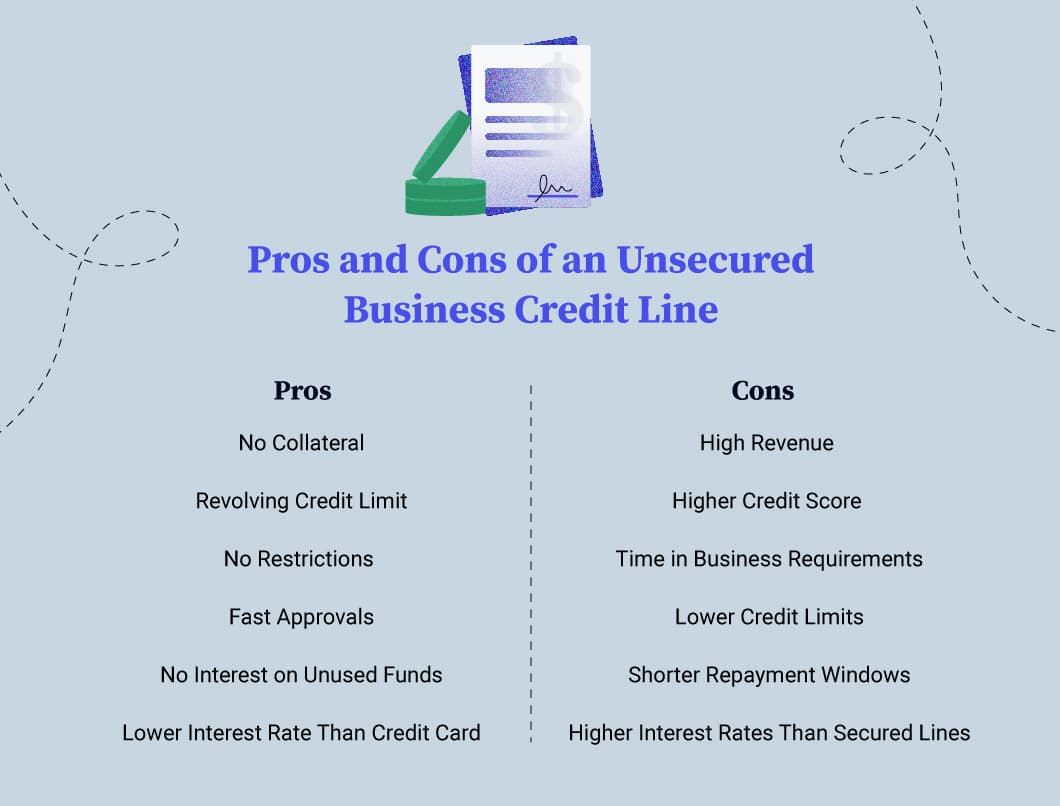

Unsecured business lines of credit are financial products that provide businesses with access to a predetermined amount of funds that they can borrow on an as-needed basis without requiring collateral. These credit lines are typically offered by banks, credit unions, or online lenders.Unlike secured lines of credit, which are backed by assets such as equipment or real estate, unsecured business lines of credit do not require any specific collateral.

Instead, lenders evaluate the creditworthiness of the business and its owners to determine the approval and terms of the credit line.

Benefits of Unsecured Business Lines of Credit for New Businesses

Unsecured business lines of credit can be particularly advantageous for new businesses that may not have established assets to use as collateral. Here are some situations where unsecured business lines of credit can be beneficial:

- Flexibility: New businesses often face fluctuating cash flow and unexpected expenses. Unsecured business lines of credit provide the flexibility to access funds when needed, helping to manage day-to-day operations or seize growth opportunities.

- Building Credit: Regularly using and repaying an unsecured business line of credit can help new businesses build a positive credit history. This can improve their credit score over time, making it easier to qualify for larger loans or better terms in the future.

- No Collateral Requirement: Without the need for collateral, new businesses can secure financing without putting their assets at risk. This can be especially beneficial for businesses that are still in the early stages of growth and want to protect their personal or business assets.

Qualifications for Unsecured Business Lines of Credit

When it comes to obtaining unsecured business lines of credit for new businesses, there are certain qualifications that lenders typically look for. These qualifications can vary depending on the financial institution, but there are some common requirements that most lenders will consider.

Personal Credit History

One of the key factors that lenders will consider when evaluating a new business for an unsecured line of credit is the personal credit history of the business owner. Lenders want to see a strong credit score and a history of responsible credit management.

A solid personal credit history can increase the chances of approval for an unsecured business line of credit.

Business Plan Importance

Having a well-thought-out business plan is crucial when applying for an unsecured business line of credit. Lenders want to see that the business has a clear plan for how the funds will be used and how the business will generate revenue to repay the credit line.

A solid business plan can help instill confidence in lenders and increase the likelihood of approval.

Benefits of Unsecured Business Lines of Credit for New Businesses

Unsecured business lines of credit offer several advantages that can be particularly beneficial for new businesses looking to establish themselves in the market.

Flexibility in Fund Usage

Unsecured business lines of credit provide flexibility in how the funds can be used, allowing new businesses to address various financial needs such as covering operational expenses, purchasing inventory, or investing in marketing strategies.

Building Credit History

By responsibly utilizing an unsecured business line of credit, new businesses can start building a positive credit history. This can be crucial for establishing credibility with lenders, suppliers, and other business partners in the future.

Opportunity for Business Growth

Unsecured credit lines can be used strategically to fuel business growth. For example, new businesses can use the funds to expand their product lines, hire additional staff, or invest in technology upgrades that enhance efficiency and competitiveness in the market.

Risks Associated with Unsecured Business Lines of Credit

When considering unsecured business lines of credit, it is important for new businesses to be aware of the potential risks involved. While these credit lines offer flexibility and quick access to funds, there are certain risks that need to be carefully managed to avoid financial pitfalls.

Increased Interest Rates

One of the risks associated with unsecured business lines of credit is the possibility of facing higher interest rates compared to secured loans. Since these credit lines do not require collateral, lenders may charge higher interest rates to offset the risk they are taking by providing unsecured funds.

Credit Score Impact

Utilizing unsecured business lines of credit can impact the credit score of a new business. If payments are missed or the credit line is maxed out, it can negatively affect the credit score, making it harder to obtain favorable terms on future loans or lines of credit.

Defaulting on Payments

Defaulting on unsecured credit lines can have serious consequences for new businesses. It can lead to legal actions, damaged credit scores, and even bankruptcy. It is crucial for businesses to make timely payments to avoid defaulting on their credit lines.

Strategies to Mitigate Risks

- Monitor Cash Flow: Keep a close eye on cash flow to ensure that there are enough funds to make timely payments on the credit line.

- Limit Credit Usage: Avoid maxing out the credit line to maintain a healthy credit utilization ratio and reduce the risk of default.

- Regularly Review Terms: Stay informed about the terms and conditions of the credit line to avoid any surprises or hidden fees.

- Seek Financial Advice: Consider consulting with financial advisors or experts to develop a sound financial strategy and mitigate risks effectively.

Closing Summary

As we conclude our exploration of Unsecured Business Lines of Credit for New Businesses, remember that these financial resources can pave the way for growth and success. Keep these insights in mind as you navigate the world of business financing.

FAQ Summary

What are the typical qualifications required for new businesses to obtain unsecured business lines of credit?

New businesses usually need to demonstrate a strong personal credit history, stable revenue, and a solid business plan to qualify for unsecured business lines of credit. Lenders may also consider the industry type and time in business.

What are the advantages of unsecured business lines of credit over other forms of financing for new businesses?

Unsecured credit lines offer flexibility, quick access to funds, and the opportunity to build a business credit history. They also do not require collateral, making them appealing to new businesses with limited assets.

What are the potential risks associated with unsecured business lines of credit for new businesses?

New businesses face risks such as high interest rates, potential damage to personal credit if the business defaults, and the risk of accumulating debt without sufficient revenue to repay. Mitigating these risks involves careful planning and financial management.